The possibilities of starting off a small business seems exciting to everyone. You may win over your customer’s hearts with some great products and service. This can make your business an instant hit. Bookkeeping is what makes your business an inside out success. Efficient bookkeeping basics that forms the backbone of your business.

Table of Contents

Bookkeeping

Bookkeeping is the process of tracking all your company’s financial transactions so that you can see exactly where your business is spending money. Using bookkeeping skill, you will be able to check the variation of revenue source you including which tax deduction you’ll be able to claim.

It’s very important to record financial transactions while you’re running a business. To handle your business properly you need to look after both the service side and also the financial side of the business. So you may have to make a decision based on your business specification which bookkeeping category will fit your business the most.

To exercise some sort of control over your business you will require the first-hand knowledge of finances. This will help you get a solid understanding of your business and what goes around it. Ultimately you will be able to make better decisions for yourself in the future.

Watch the following video to get a better idea on bookkeeping-

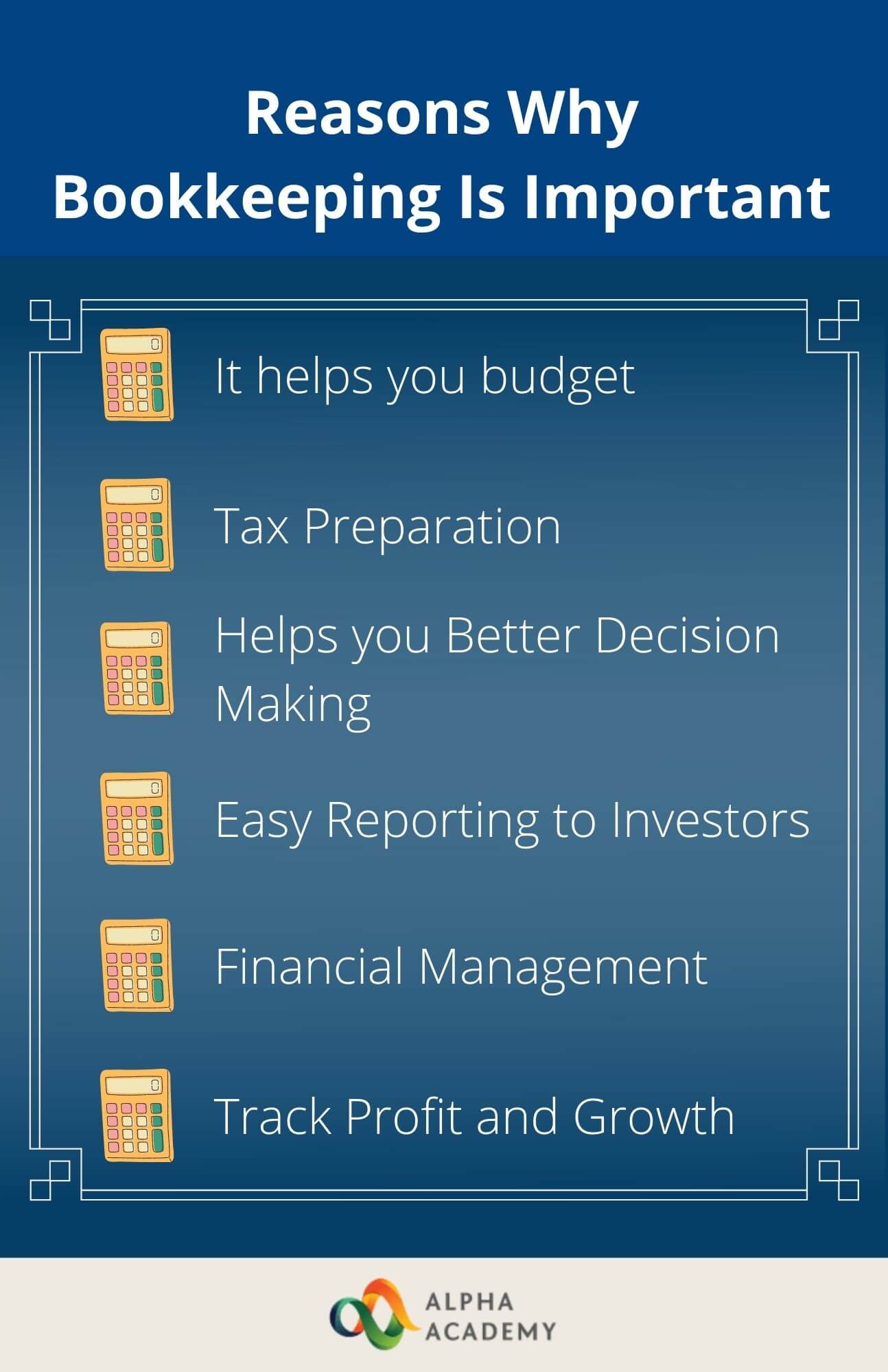

The importance of bookkeeping to the new entrepreneurs

Bookkeeping is an essential parameter to keep in hand if you want your business to attain long term success. A better understanding of the state of finances will help you make better decisions for your business.

Accurate bookkeeping will ensure you with the practical real time data. It will open paths for you business to explore new possibilities.

Now, you know the basic definition of bookkeeping and reasons behind the importance of it. At this point, we will move into the coire part of Bookkeeping basics you can’t afford to ignore.

10 Bookkeeping Basics You Can’t Afford to Ignore

1. What type of accounting system should you imply for bookkeeping

This is one of the very first decisions you have to make while you are setting up a new business.Among different types of bookkeeping methods, Accrual accounting is preferred by larger businesses. This is because it gives the organization a clearer picture of the company’s income and expenses.

Accrual accounting is an accounting method where the records of revenue or expenses are kept when the transaction occurs. Not when the actual payment is received or made.

For a one-person business you may as well stick to cash accounting. Cash accounting is a form of accounting where revenue and expenses are recorded when cash is received or paid. In this system transaction takes place with the direct exchange of money. Cash accounting is a simple way to keep track of money going in or out.

In the beginning you may operate your business with a single bank account. It will get you going with all your business transactions. You can start using multiple accounts once your business starts to add more people and payments start to diversify.

2. What type of bookkeeping entry methods are used

Financial transaction of your business is all to be recorded in a detailed way in a journal. There are two ways to keep records of financial transactions. One is a single entry and the other is a double entry bookkeeping system..

In the single-entry bookkeeping system, the financial record of every transaction is recorded once in the journal, transaction log or a cash register. While in a double-entry bookkeeping system certain cash flow from a customer will result in two different entries. Firstly a credit entry in one account and an offsetting debit entry.

- A double-entry system starts with a journal.

- This is followed by a ledger. Transactions are balanced in ledger.

-

Transactions are then compiled into a trial balance. All ledgers are compiled into credit and debit columns. Every company prepares trial balance periodically.

- Finally financial statements are prepared from balance sheets. Financial statement consists of all business activities.

If your business gets anymore complex than a one person

3. Initial bookkeeping terminology

A few basic bookkeeping terms such as assets, liabilities and equity along with a few advanced terms are

- Assets: Anything owned by the company that has value and can be used to mitigate debt.

- Liabilities: Anything that a business or a company owes to someone else is called liabilities. Liabilities are loans, accounts payables, wages payment, interest etc. In simple words assets put back money into your pocket while liabilities take out money

-

Owner’s equity: The owner’s investment in the business subtracted by what he draws out from the company is called owner's equity. The owners equity can also be viewed as an asset to the company.

Assets= Equity + Liabilities

- Income: Income is the revenue the business earns by selling products and services of the business.

- Expense: Expense is the money that a business spends to generate the revenue.

- Ledger: Transactions are posted from journals into individual accounts known as ledger. This is a book where transactions are divided and recorded in separate accounts for balance sheet and income statement transactions. It must be balanced.

-

Journal: A journal is a record book where the transactions are recorded in chronological order of time. It is not necessary to be balanced.

- Financial statements: These are the written summary reports that convey the organization’s financial results, position, and cash flow.

4. Balancing the books

In a double entry system the total of the debit balances should always equal the total credit balances. It serves as a check to ensure for every debit in a ledger account has been matched with a corresponding credit in another ledger account.This is the main difference between a single entry and a double entry system.

5. How long can you keep up with the traditional methods

Once after starting off your business venture you may have followed just a single entry method to keep records of basic accounting in your business. But with the increase of cash flow in your business you may need to follow a double entry system to maintain in house bookkeeping.

A major disadvantage of traditional bookkeeping is that it takes a lot of time and is a labour intensive process. Balancing a hand written account is very time consuming.

So business owners can also look forward to bookkeeping software’s such as Sage 50, quick books. You may even use MS excel to create columns and keep invoice records of your transactions that will save your time.

6. Record all financial transactions

In order to run your business efficiently there is no alternative to keep track of all your finances. It is a crucial part of your business to record each transaction to the right chart of accounts. Otherwise your debits won’t match your credits and you won’t be able to close your book. A tip that good bookkeepers follow is to take on the records in the initial part of the day.

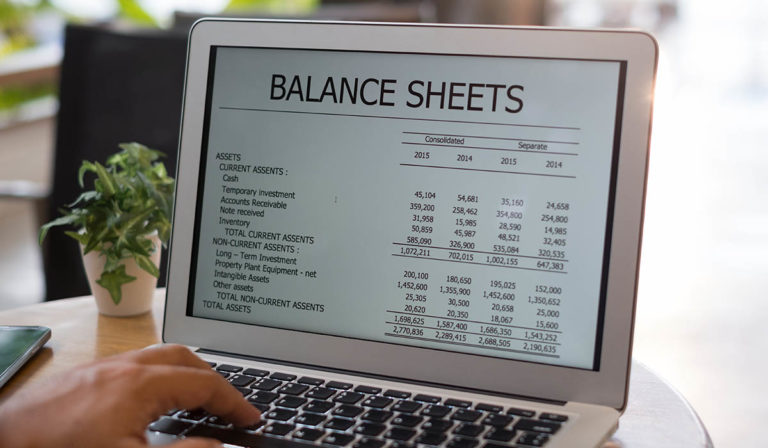

7. Prepare financial reports from bookkeeping

One of the main advantages of preparing a balance sheet is to get a quick financial overview of your business. Importance of bookkeeping in maintaining the proper financial layout of a company can never be ruled out.

Balance sheets are the summaries of your assets, liabilities and equity at any given time. The balance sheet provides valuable insights of the company’s financial health. The profit and loss statement of a business gives an exclusive breakdown of your company’s revenue, cost and expenses.

8. How bookkeeping helps you do tax

Good and dependable bookkeeping is an essential to make accurate income tax returns. Without dependable financial records your business might end up paying more tax. This will decrease your total turnover. Again by paying less tax than what you owe your company may have to face charges that might be brought up against you in case of a government audit.

9. When to seek help when necessary

Unless you are an expert to start off with, It is not recommended to take bookkeeping so lightly. It is a very challenging task, especially at the beginning of any business when the setup is underway.

So to get to your basics straight you might consider taking an online bookkeeping course. This will help you get a head start in your journey. Our bookkeeping course will get you through the very basics of bookkeeping fairly quickly. The online course has been designed to enable you to implement the lessons you learned directly into your business.

Having better financial health can also help the company retain your investment and help you re-inject your money back into the business. Accurate bookkeeping will also protect your business from unwanted disputes that usually occur while trading. This will also prevent frauds and save you from invoking any tax penalties due to financial errors.

As with all other businesses your business may also initially operate as a small business involving a limited number of personnel. So it’s normal for you to keep your own records. But your business will climb through stages of entrepreneurial growth. So at some stage you may fall short of time and may have to look for outside help to keep track of your transactions.

You may consider hiring an in house accountant if your business gets big enough so you can afford one. Besides that you may also seek help from an accounting software. Nowadays apart from onsite accountants there are also virtual accountants working remotely with the help of available modern day technologies. This may just require you to enter the record and get a fully prepared balance sheet with the help of virtual bookkeeping.

10. Create a schedule and keep records sincerely

After selecting the basic accounting guidethat you have determined will best fit your business, your job is to abide by those instructions. It’s always advantageous for small businesses to keep up with the day to day proceedings. Nobody would like to waste time chasing previous weeks’ reports.

After you are up and running all ends up with your business making a schedule to follow up on your dealings. Make bookkeeping notes where where necessary. Check back on record all financial transactions, including incoming invoices, bill payments, sales, and purchases at least once every week. You may even consider hiring a professional for this when the job gets too big.

Read More

- Benefits of Taking Online Courses for Your Education and Career Growth

- 12 Optimum Ways to Compare & Set Proofreading Rates in Your Field

- Writing Marketing Copy

- Youtube Monitization Guide – How to Monitize Youtube Channel

- How to Get Promoted in 2024 – 8 Best Practices

- Project Management : Guide to Become a Project Manager

- How to Develop a Business Plan

- How Online Courses Are Changing the Education Landscape

- Unlocking Academic Success: The Role of Professional Assignment Help Services

- Choosing the Right Code Editor – Features to Look For

0 responses on "10 Bookkeeping Basics You Can’t Afford to Ignore"